In 2026, “energy” in beverages is no longer a one-dimensional promise. The category is entering a new chapter where consumers don’t just want a quick lift—they want energy that fits the moment, the lifestyle, and the day’s rhythm. That shift is powering a clear global wave: Next-Gen Energy Drinks. This is not simply about launching another can into an already crowded shelf. It’s about how the category is evolving—toward sharper positioning, better everyday relevance, and portfolio strategies that allow brands and importers to scale with less risk and stronger repeat purchase.

For B2B importers, distributors, and beverage investors, this evolution is a rare kind of opportunity. When a category upgrades its “rules of the game,” new players can enter with a smarter structure—one that is built on modern demand patterns rather than outdated assumptions. Next-Gen Energy Drinks are opening space for importers to build a brand with a long runway: a brand that can start with a strong core product and expand into a portfolio as local demand becomes clearer.

This article is written for B2B decision-makers who want a forward-looking, market-driven view of 2026 energy drink trends—without hype and without superficial buzzwords. We’ll focus on what is changing, why it matters, and how importers can position themselves for sustainable growth with SunSip Energy.

Why Next-Gen Energy Drinks Are Accelerating in 2026

Energy drinks have traditionally been associated with extreme performance, nightlife, and high-intensity consumption occasions. That world still exists, but the center of gravity is shifting. In 2026, the category is expanding into everyday routines—workdays, study sessions, commuting, on-the-go schedules, and productivity moments where people need to stay sharp and keep moving.

This “everyday energy” expansion matters because it changes how consumers choose products. Instead of buying energy drinks only for special situations, more people are integrating them into their weekly habits. That brings two powerful outcomes for the market. First, the customer base grows beyond the traditional “core user.” Second, repeat purchase becomes more consistent, because the product is tied to routine rather than a rare occasion.

Next-Gen Energy Drinks thrive in this environment because they are designed to be more context-aware. The category is becoming more segmented by use case—meaning products win when they speak clearly to a specific need and a specific moment. In other words, energy is no longer a generic claim; it’s a targeted value proposition that can be understood quickly on shelf and remembered easily after the first try.

For importers, this is exactly the kind of category movement that rewards strategic portfolio building. When the market is evolving, the winners are often not the brands with the loudest message, but the ones with the clearest structure and the most repeatable go-to-market model.

The Three Market Forces Shaping Energy Drinks in 2026

While every country has its own retail reality, three major forces are shaping the broader energy drink direction in 2026. Understanding these forces helps importers invest with logic, not guesswork.

The first force is the shift from “extreme energy” to “lifestyle energy.” Consumers are choosing products that fit how they see themselves. The brand image and the packaging language are becoming as important as the functional promise. This pushes demand toward modern visuals, cleaner storytelling, and positioning that feels relevant to daily life.

The second force is deeper segmentation by need state. A fast-moving category becomes more competitive, and competition drives specialization. In 2026, energy drinks are not just energy drinks—they are products designed around moments: a long workday, a busy retail shift, a study marathon, an early morning reset, or a pre-activity boost. When a product matches a moment, consumers don’t need to think long; they simply recognize it as “for me, right now.”

The third force is taste and experience becoming non-negotiable. In mature categories, repeat purchase is driven by enjoyment, not only by function. That means flavor profile, mouthfeel, and the overall drinking experience are central to retention. In other words, function triggers the first purchase, but experience wins the second and third.

This triad—lifestyle relevance, need-state clarity, and taste-driven retention—defines what Next-Gen Energy Drinks look like in 2026. It also provides importers with a clear lens for product selection and brand building.

What This Means for B2B Importers and Beverage Investors

For B2B buyers, the big mistake in energy drinks is treating the category like a single SKU race. Many importers ask, “Which flavor is trending?” when the better question is, “What portfolio structure fits my market and channel strategy?”

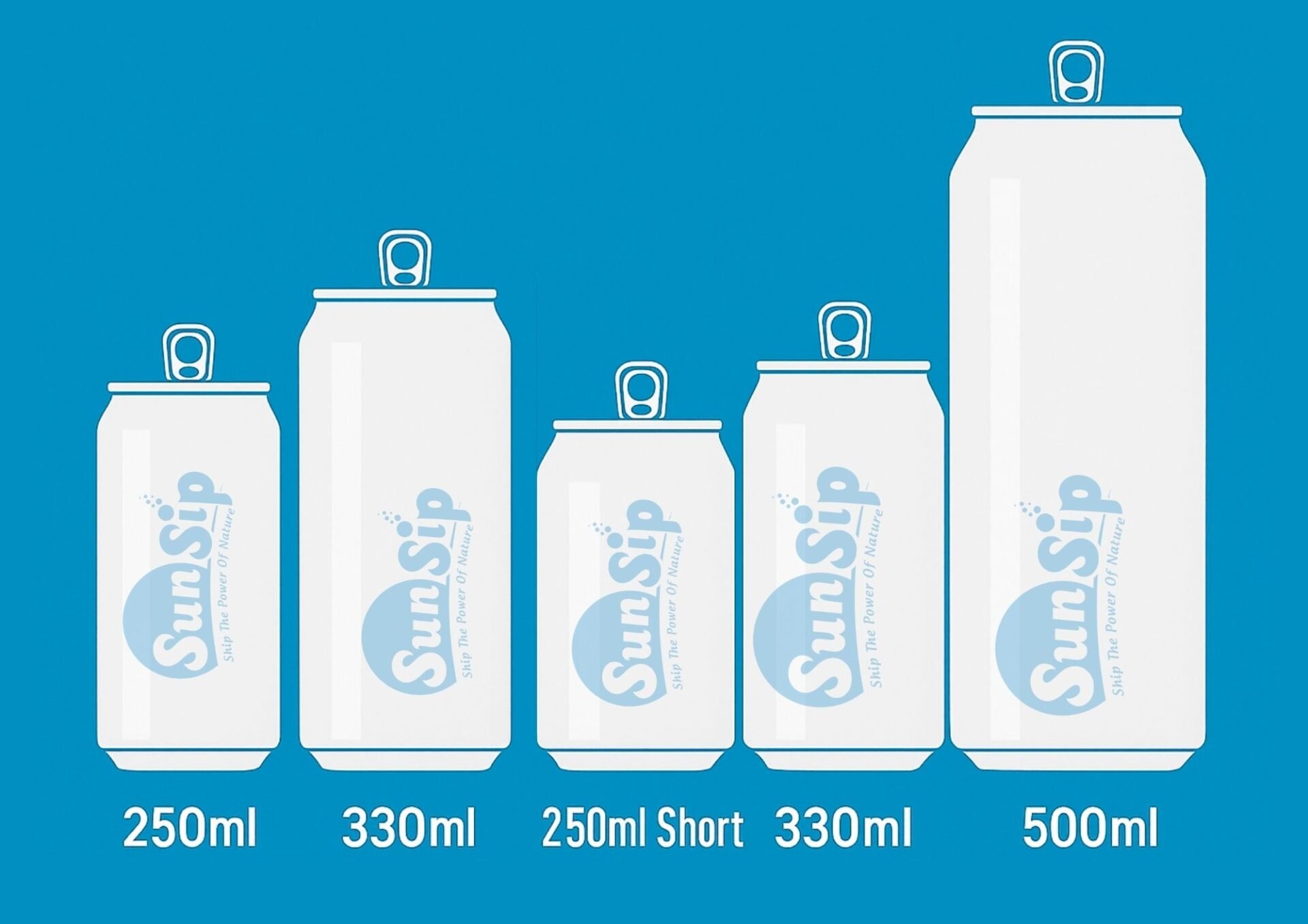

Next-Gen Energy Drinks reward importers who build a portfolio with a spine. A spine means you start with a core product that is easy to sell through convenience channels and high-rotation retail environments. The core product is the engine—it generates shelf presence, store confidence, and a steady base of reorder activity.

Once the core is established, you expand into more specific variants that match targeted consumer moments. This approach reduces risk. Instead of launching many SKUs at once and hoping something sticks, you launch with a clear path: core first, segmentation second. That is how importers turn energy drinks into a scalable business, not a short-term shipment.

From an investment angle, energy drinks remain attractive because the model can compound. If the product fits routine consumption and the supply chain remains stable, every new retail door and every additional region can generate repeating returns. In categories built around habit and visibility, scale creates efficiency. Distribution becomes stronger over time, the brand becomes easier to sell, and the cost of growing each next step can decline.

But this compounding only happens if the importer chooses the right manufacturing partner—one capable of stable quality, consistent supply, and B2B-friendly cooperation.

The Importer’s Advantage in 2026: Winning Through Portfolio Strategy

In 2026, the importer who wins is not necessarily the one who moves the most containers first. The winner is the one who builds a brand that can scale while keeping operations predictable.

That requires a portfolio strategy that matches local market behavior. In many markets, energy drinks perform best when the brand can win in convenience stores and fast retail channels first, because those channels build trial volume quickly. Once trial becomes habit, the brand can widen its presence into more structured retail and larger distribution networks.

A strong portfolio strategy is also a communication strategy. Each product must have a simple story that sales teams can communicate within seconds. This matters especially in B2B distribution, where retailers need clarity: what it is, who it is for, and why it will move off the shelf.

When your portfolio is structured correctly, the business becomes easier to manage. Sales becomes more repeatable. Retailers feel confident. Consumers recognize the brand. And you can expand with lower friction.

The B2B Opportunity with SunSip Energy Drinks

SunSip Energy is positioned to support importers who want to enter or expand in the Next-Gen Energy Drink wave with a long-term model rather than a one-off shipment mentality. For importers, the most valuable advantage is not just buying a product—it’s working with a manufacturing partner who can align with your market strategy.

The right way to think about SunSip Energy in 2026 is as a foundation for building a portfolio. You can start with a strong core product designed to build rotation and visibility. Then, as your market data grows—by channel, region, and customer segment—you can refine your lineup to fit real demand patterns rather than assumptions.

This model is especially valuable for importers who want to build a private label or branded distribution business with stability. In B2B, stability is a competitive advantage. When a brand delivers consistent quality and reliable resupply, retailers reorder with confidence, and the importer gains negotiating power across channels.

SunSip Energy can support importers in building that stability—helping the product become a repeatable distribution asset rather than a risky experiment. In a 2026 market defined by speed and competition, importers who can move quickly without losing reliability will hold the advantage.

How Importers Can Launch Smarter in 2026

A smart launch is not about doing more; it’s about sequencing correctly. In Next-Gen Energy Drinks, importers tend to succeed when they follow a three-stage growth rhythm.

Stage one is market validation with a clear channel focus. The goal is not to cover the whole country immediately. The goal is to identify where trial converts best—where consumers are most likely to purchase again within a short period. This stage generates the data that guides everything else.

Stage two is scaling through distribution consistency. Once you see where repeat purchase happens, you increase presence in those channels and regions. Retailers begin to recognize the brand. Reorders become predictable. This stage is where operational stability creates real business value.

Stage three is portfolio expansion based on real demand. Instead of expanding blindly, you expand based on what the market has already proven. This is where Next-Gen strategy becomes powerful: you introduce products that match clear moments and clear audiences, and you strengthen the brand’s footprint in a structured way.

This sequencing reduces risk and increases long-term margin. It also makes sales easier because each step builds on the previous one.

Why 2026 Will Reward Importers Who Think Long-Term

Next-Gen Energy Drinks are not a short-term trend. They represent a market evolution toward clearer segmentation, broader everyday consumption, and stronger brand-experience expectations. That evolution favors importers who operate like builders—not traders.

When you treat the category as a long-term business, you invest in the fundamentals: portfolio structure, channel strategy, brand storytelling, and reliable supply. These fundamentals create compounding effects. Every successful reorder strengthens your distribution network. Every new retailer becomes easier to win. Every additional region becomes faster to scale.

The importer opportunity in 2026 is not simply to “bring in an energy drink.” It is to bring in a Next-Gen platform—one that can become a recognizable brand with a scalable portfolio.

SunSip Energy is built to support this kind of importer thinking. If your goal is stable growth through distribution and long-term cooperation, the category is moving in your favor—and 2026 is a timely moment to act.

Closing Thought for B2B Buyers

The real question is not whether energy drinks will remain strong in 2026. The real question is who will capture the next wave of growth. In a world where the category is upgrading, winners are defined by strategy: clear positioning, smart portfolio sequencing, and partnerships built for consistency.

If you are an importer, distributor, or beverage investor planning your 2026 portfolio, Next-Gen Energy Drinks deserve a serious look. And if you want to develop a business that can scale through repeat demand, SunSip Energy offers a strong foundation for that journey.

Request Quotation / OEM Beverage Consultation

Website: sunsipbeverages.com.vn

Email: info@sunsipbeverages.com.vn

WhatsApp: (+1) 719 244 5414